vermont income tax rate 2020

W-4VT Employees Withholding Allowance Certificate. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875.

TaxTables-2020pdf 27684 KB File Format.

. The bill proposes to raise the estate tax exclusion over the course of two years. Vermonts tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. 2022 Interest Rates Memo.

Tax Rate Class. 0 0 0 0. A financial advisor in Vermontcan help you understand.

2020 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Then your VT Tax is. Beginning January 1 2020 the estate tax exclusion.

Enter 3220 on Form IN-111 Line 8. Tuesday January 18 2022 - 1200. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. 15 15 15 15. W-4VT Employees Withholding Allowance Certificate.

Filing as Married Filing Jointly generally results in paying lower federal and Vermont state income tax rates compared to the other four filing statuses. The rate notice provides you with your new unemployment tax rate. It is sent out annually in June and the rate is effective from July 1st until June 30th.

As you can see your Vermont income is taxed at different rates within the given tax brackets. 18 18 18 18. 2020 Vermont Tax Rate Schedules Example.

Personal Income Tax Research Statistical Data. Meanwhile total state and local sales taxes range from 6 to 7. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US.

THE TAX SCHEDULES AND RATES ARE AS FOLLOWS. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. 2020 Tax Rates per 100 Valuation for Tarrant County Cities County Special Districts HS O65 DP HS O65 DP State.

Filing Status is Married Filing Jointly. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. 8 8 8 8.

Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. Individuals Personal Income Tax. TDC Jurisdiction Name Tax Rate State Mandated.

2019 VT Tax Tables. Check the 2020 Vermont state tax rate and the rules to calculate state income tax. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. Vermont Tax Brackets for Tax Year 2020. Vermont Income Tax Return.

If youre married filing taxes jointly theres a tax rate of 335 from 0 to 67450. Personal Income Tax - 2020 VT Tax Tables. Personal Income Tax - 2019 VT Rate Schedules.

Pay Estimated Income Tax by Voucher. For Adjusted Gross Incomes IN-111 Line 1 exceeding 150000 Line 8 is the greater of 1 3 of Adjusted Gross Income. IN-111 Vermont Income Tax Return.

5 5 5 5. How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table. Currently the estate tax is 16 on the value of any estate over the exclusion amount of 275 million.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent.

This form is for income earned in tax year 2021 with tax returns due in April 2022. RateSched-2020pdf 11722 KB File Format. This marginal tax rate means that.

More about the Vermont Tax Rate Schedules. Individual Tax Rate Schedule. If you make 70000 a year living in the region of Vermont USA you will be taxed 12902.

Detailed Vermont state income tax rates and brackets are available on this page. 2020 Vermont Tax Tables. Your average tax rate is 1198 and your marginal tax rate is 22.

PA-1 Special Power of Attorney. 12 12 12 12. For wages paid in 2020 Interest Rate Summary.

Tax Rates and Charts Mon 01112021 - 1200. 4232021 21024 PM. Local Option Alcoholic Beverage Tax.

2020 Vermont Tax Deduction Amounts. PA-1 Special Power of Attorney. 2020 Vermont Income Tax Statistics - State.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. Vermont also has a 600 percent to 85 percent corporate income tax rate. We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes.

Monday March 1 2021 - 1200. Tax Bracket Tax Rate. Find your pretax deductions including 401K flexible account contributions.

VT Taxable Income is 82000 Form IN-111 Line 7. Base Tax is of 3220. Find your gross income.

2020 TAX RATES FOR WEBSITExlsx Author. Monday February 8 2021 - 1200. Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax bracket to 875 the highest Vermont.

This column also applies to qualifying widower and civil union filing jointly status This column also applies to civil union filing separately status. Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid. Find your income exemptions.

Tax Year 2020 Personal Income Tax - VT Rate Schedules. Income_stats_2020_statepdf 1772 KB File Format. The taxable wage figures are taken from the quarterly unemployment tax returns you and the benefits are from our submitted record of unemployment benefit claims paid out to your employees.

Education Property Tax Rates. Pay Estimated Income Tax Online.

Tax Foundation On Twitter South Dakota Inbound Map

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Rheinblick Golf Course Wiesbaden Us Army Mwr

Andrew Cross Chief Financial Officer Asian Infrastructure Investment Bank Linkedin

Alcohol Consumption In The United States Vivid Maps Heavy Drinking Map Information Visualization

Leading Consulting Firms Prestige Ranking U S 2021 Statista

Happy Patriots Day 2020 Patriots Day Boston Real Estate Boston Things To Do

Rheinblick Golf Course Wiesbaden Us Army Mwr

Will The Sustainability Strategy Of The London Stock Exchange Group Lseg Have Green Teeth

Rheinblick Golf Course Wiesbaden Us Army Mwr

Pin On Tips For Small Biz Owners

Leading Consulting Firms Prestige Ranking U S 2021 Statista

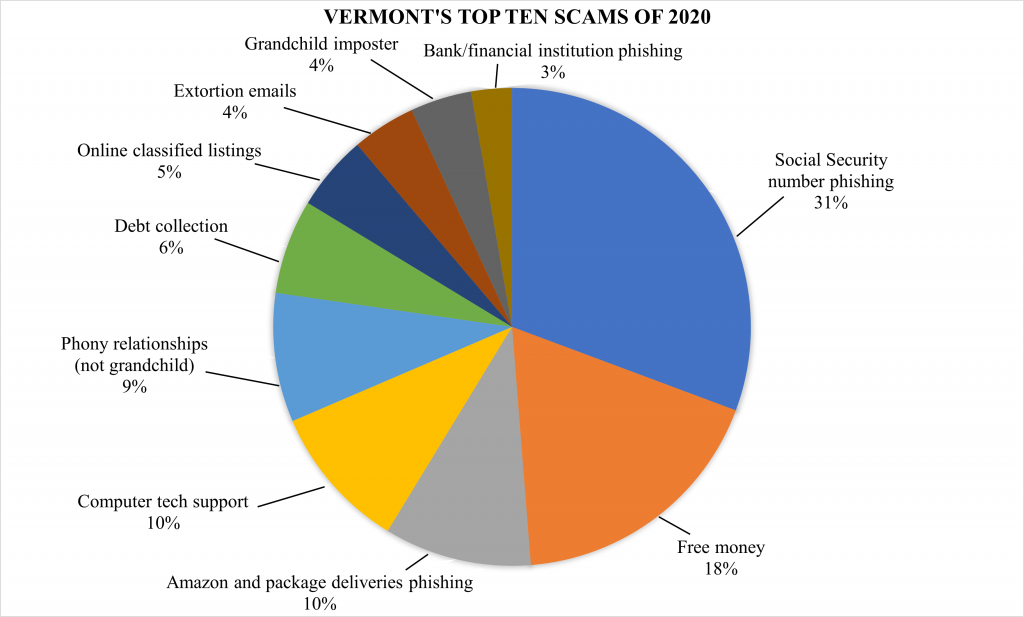

Top 10 Scams Of 2020 Released By Attorney General S Office Office Of The Vermont Attorney General

Crypto Exchanges Bitfinex And Ethfinex Jointly Launch Initial Exchange Offering Platform Cryptocurrency Vulnerability Blockchain